Hedging Bets: Oil and Gas in the Canadian Arctic

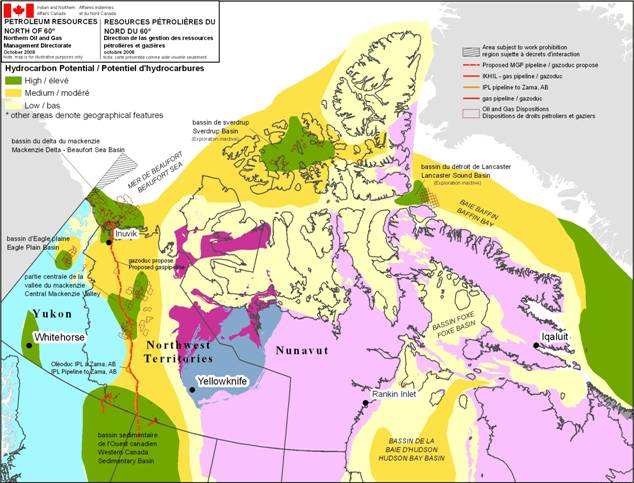

Petroleum resources north of 60 degrees latitude in Canada. Map: Indian and Northern Affairs Canada

Higher hydrocarbon price levels and new technology, coupled with optimistic resource appraisals at the turn of the millennium, have made the Canadian Arctic an attractive prospect for oil and gas multinationals. It is estimated that ‘approximately 35% of Canada’s remaining marketable resources of natural gas and 37% of remaining recoverable crude oil is in Northern Canada’.1)

Of particular interest are the offshore resources present in the Canadian part of the Beaufort Sea, located just off the coast of the Northwest Territories. While this region of Canada is attracting the interests of a range of new players, both commercial and political, interest on its own is not sufficient for any rapid development to take place. As this article will outline, there are several factors that may restrict the viability of Canadian Arctic oil and gas despite its ostensible opportunities.

Historic Development

Canadian Arctic oil and gas development started with the discovery of the Norman Wells oil field in 1920, but onshore activity in the region did not intensify until oil was found in 1968 across the border at Prudhoe Bay in Alaska. In this period offshore exploration in the Beaufort Sea also intensified. A total of 86 wells were drilled from 1972 until 1989; an impressive number given the harsh conditions and uncertain commercial prospects of the area. However, although several Canadian companies had been active in promoting the petroleum potential of the Beaufort Sea, the Arctic was mostly abandoned from the mid 80s as oil prices fell and transportation of any findings became problematic.2)

Renewed Interest in the Arctic

Lease sale rounds were conducted in 2002 and 2004 by the Canadian federal government, which is responsible for offshore development of the Beaufort Sea. Chevron Oil Company acquired leases in the Mackenzie Delta for a relatively small fee during that time, while in 2007 Imperial Oil won the bid for a larger area further offshore. BP did the same in 2008, with Chevron following suit in 2010.3) As the Deepwater Horizon incident in the Gulf of Mexico began to unravel in 2010, Canadian authorities imposed a halt on all Arctic drilling until the National Energy Board (NEB) had conducted an Arctic Offshore Drilling Review.4) Released in December 2011, the Review introduced a more stringent set of guidelines to which any company operating in the region would need to adhere.5) Beyond these rigorous operating standards, however, three additional challenges have the potential to hinder further lease development in the Canadian Arctic.

Price Levels

The Canadian Arctic, particularly the Mackenzie Valley Delta and adjacent offshore fields in the Beaufort Sea, is expected largely to contain natural gas deposits. The Henry Hub natural gas spot price for the North American market, however, has seen a remarkable shift the last decade. Following the relatively low level of USD2.36 per MMBtu of natural gas in December 1999, prices rose and alternated between USD4.47 and USD13.42 from late 2002 to 2009. In 2010, a relatively sudden boom in domestic shale gas production led the United States to embark on a path to self-sufficiency in natural gas. Price levels have dropped accordingly. Between 2010 and 2011, gas cost around USD4 per MMBtu, while in 2012 it hung between USD1.95 (April) and USD3.54 (December).6) This has led to questions concerning the commercial viability of Canadian Arctic gas projects, in which the cost of extraction often does not warrant activity.

Infrastructure

Any development of the Canadian Beaufort Sea is dependent on finding viable options for transportation for extracted resources. Canada never built a pipeline equivalent to the Trans-Alaska Pipeline System in the United States, as indigenous and environmental concerns halted the process of building a comparable gas pipeline through the Mackenzie Valley in the 1970s.7) Stretching from the Northwest Territories of Canada to North American gas markets, the proposed Mackenzie Valley Pipeline would cover roughly 743 miles of Canadian territory to connect to the existing continental gas pipeline system.8) However, the future of the project remains uncertain: current North American gas prices do not warrant investment and permits are still pending. Indeed, it is fair to say that Canada’s Mackenzie Valley Pipeline faces considerable economic and political challenges and therefore acts as barrier to investments in Canadian Arctic gas production. LNG facilities onshore have been mentioned as an alternative, but current price levels also render this option uncertain.

Regional and Federal Interests

At the regional level, the Northwest Territories’ interests in offshore development of the Beaufort Sea do not constitute a particularly strong driver in themselves. The region is not heavily dependent on revenues from oil and gas given that current production levels remain low. Additionally, local communities in the region have focused extensively on developing mineral deposits instead of oil and gas.9) With the success of the diamond mines in the Northwest Territories, sentiment tends to favor mineral extraction, which is perceived to provide greater direct benefits in terms of revenues and labor.

Given that regional interests do not constitute a strong driver for further expansion in the Beaufort Sea, the decision to open for offshore lease sales and approve exploratory drillings is more closely linked to federal interests in Ottawa. These interests play into the fact that Canada is emerging as an international heavyweight in oil and gas production due to the presence of tar sands in Alberta and petroleum production in the provinces of New Brunswick and Newfoundland. A federal push to develop costly and remote Arctic gas fields is therefore not inevitable, since Canada is not dependent on these resources for domestic energy supply. Although players at both the regional and federal levels openly favor oil and gas development in the Arctic, there is less leveraging of these interests in comparison to other parts of the Arctic in which oil and gas discussions are taking place.

Conclusion

By contrast to oil and gas development in the European Arctic and other areas of North America, development in the Canadian Arctic appears less defined in terms of commercial viability. Moreover, regional and federal-level interests are vocalised less strongly than those encountered in neighbouring Alaska. Should large quantities of recoverable oil or gas be discovered in the near future, this situation may change rapidly. Nonetheless, the challenges described above – relating to price levels, transportation, and a lack of national interest – will continue to weigh upon development in the short to medium-term. It is reasonable to conclude that development of the Canadian Arctic is still only a possibility and not a given, even in the context of strong and increasing commercial and political interest.

The article is based on an ongoing study that the author is conducting within the international research programme Geopolitics in the High North.

References