Despite Global Warming Suez Canal will remain preferred shipping route in coming decades new study suggests

The Russian tanker Renda transits toward the port of Nome, Alaska, Jan. 13, 2012. Renda was assisted by the U.S. Coast Guard cutter Healy (WAGB 20) since the vessels left Dutch Harbor, Alaska, to deliver fuel to the city of Nome, which was iced in by winter storms. Source: Charly Hengen

A new study on the commercial opportunities and challenges of Arctic shipping by researchers at Copenhagen Business School’s Maritime Division finds that the navigation season on the Northern Sea Route (NSR) will remain too short for investments in ice-class vessels to be economically viable in the coming decades. Only after the year 2035 may the Arctic shipping route along Russia’s northern coast became competitive for some ships of comparable size.

The study aimed at determining when (if ever) the investment in an ice-reinforced container ship operating along the NSR would be preferable to the investment in an open water vessel solely navigating the Suez Canal Route.

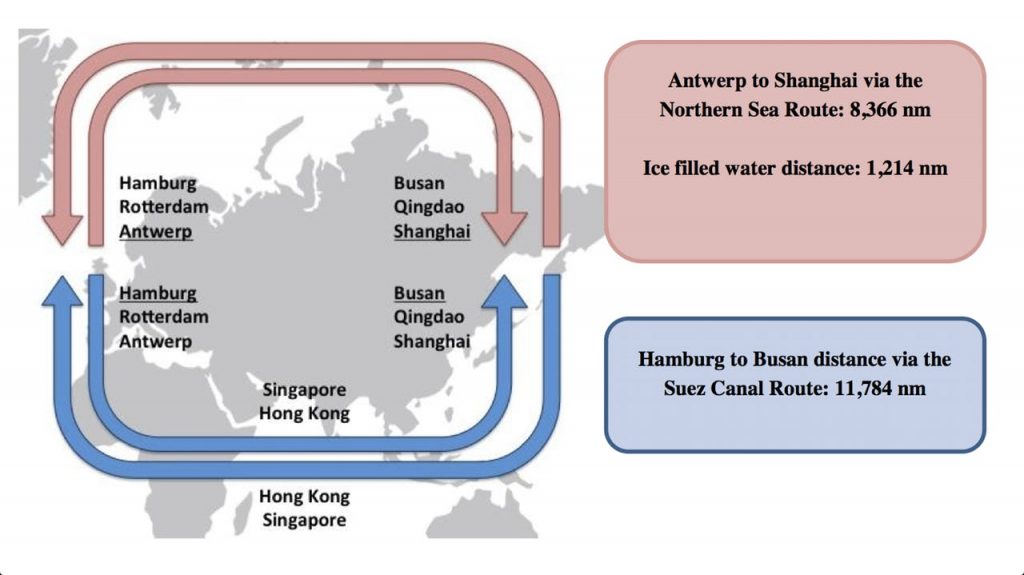

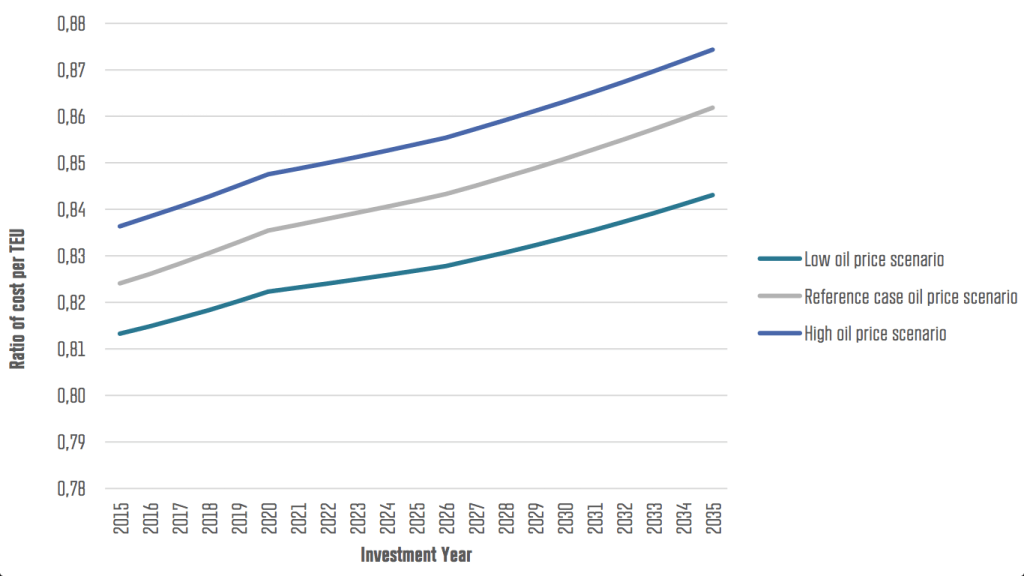

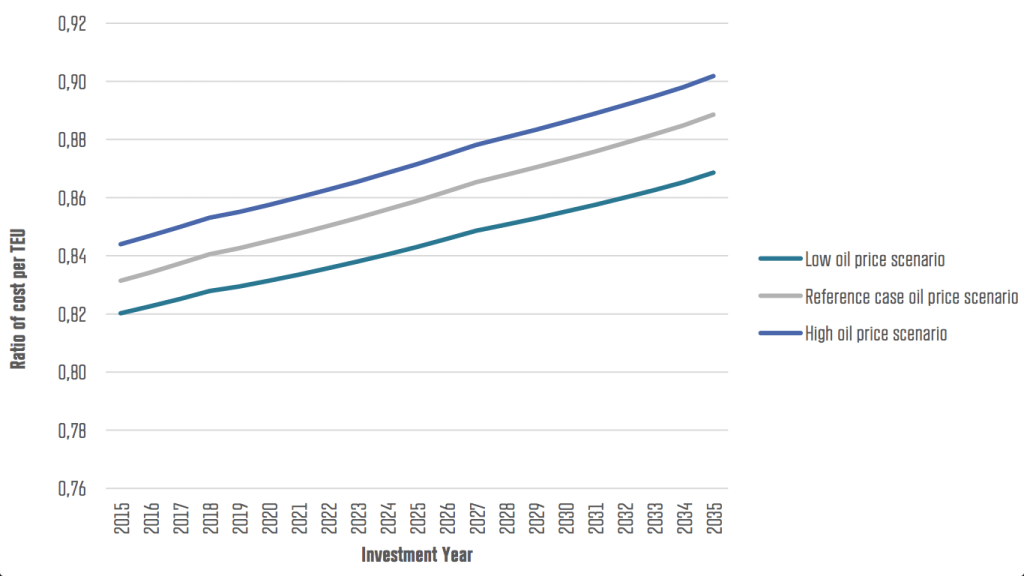

The authors compared a vessel operating on the NSR with a capacity of 8000 containers (TEU) to three open water container ships operating on the SCR with container capacities of 8000 TEU, 10000 TEU and 15000 TEU, respectively. As part of the study the ice-reinforced vessel was assumed to operate along the NSR during the navigation season and the SCR when ice prevents access to Arctic waters.

CBS’ study employed an innovative calculation tool to determine the year when a given investment for ice-reinforced vessels destined to operate on the NSR would become favorable to an ordinary container ship sailing along the Suez Canal Route. Using the tool researchers calculated the comparative costs per container taking into account more than a dozen variables including vessel specification and size, engine type and capacity, average speed and distance, navigation season, transit fees, and load factors. According to the study’s authors the tool combines an economic framework with applied naval engineering and is the first of its kind specifically designed to compare Arctic shipping to traditional routes.

Furthermore, rather than making deterministic statements about Arctic shipping from a single point in time, the complex methods applied allow for the creation of detailed scenarios to understand how different factors and variables influence the feasibility of using the NSR for transport and when under a given scenario a break-even point may occur. Thus the tool allows for a detailed look at how e.g. higher or lower fuel prices affect the economic calculation of shipping via the Arctic.

According to Peter Grønsedt, senior researcher on the study, “The annual navigation season is currently too short to offset the higher fuel consumption and capital costs of the ice-reinforced vessels compared to SCR vessels.” Furthermore, “the navigation season remains too unstable in order to maintain the strict time schedule upon which most liner service relies.”

The study analyzed a number of scenarios, including “slow steaming” where ships sail at slower speeds to reduce fuel costs. In this respect Grønsedt concludes that “operators may achieve additional cost savings by utilizing the reduced distance of the NSR to operate at lower speeds compared to the Suez Canal Route.” “However, the recent fall in oil prices has lowered the incentive of using the Arctic routes despite the reduced sailing distances.”

While the study’s results imply that Arctic liner shipping may become economically feasible around 2040 the possibility of regular traffic along the NSR rests upon several crucial assumptions which are all subject to major uncertainties.

These uncertainties include vessel sizes, icebreaker availability, entry deterrence such as transit and icebreaker fees, fuel prices, port availability and the future decline in sea ice. Even if the ice-free navigation season expands rapidly and fuel prices increase significantly, the largest vessels on the SCR would likely be able to operate at lower costs due to the economics of scale.

The study’s authors have made the calculation tool available for download to allow researchers and industry professionals to create their own scenarios by manipulating variables and determining when or if a break even point may be reached.