Canada in the Arctic - Arctic Oil and Gas: Reserves, Activities, and Disputes

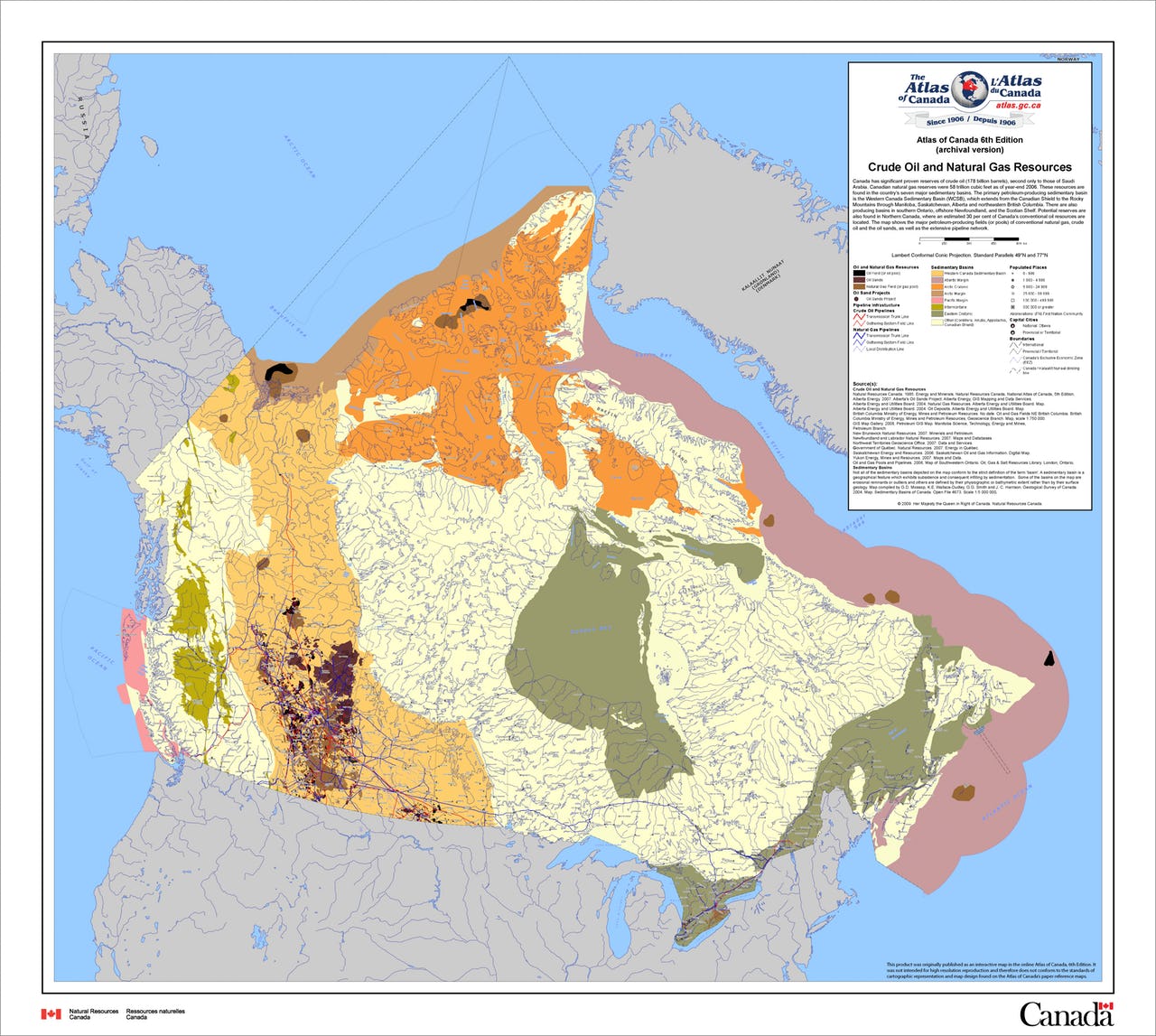

The map shows Canada’s major petroleum-producing fields (or pools) of conventional natural gas, crude oil and the oil sands, as well as the extensive pipeline network. Map: Natural Resources Canada

Canada has recorded 90 major offshore oil and natural gas discoveries since 1964. Most Canadian petroleum companies are active in both crude oil and natural gas development and the level of capital investment in exploration and development has increased significantly in recent years. Capital investment in the conventional oil and gas industry has grown steadily from an average of CAN$ 5 billion in the early 1990s to CAN$ 10 billion per year in 2006. Map 1 gives an overview of Canada’s seven major sedimentary basins with the major petroleum-producing fields of conventional natural gas, crude oil and oil sands. The red and blue lines illustrate the existing oil and gas pipelines.

According to the 2007 Arctic Monitoring and Assessment Programme Assessment Report “Oil and Gas in the Arctic: Effects and Potential Effects”, Canada issued most licences for Arctic land in the late 1960s and early 1970s, late 1980s and again in the early 2000s. Seismic data acquisition in Canada peaked in the early 1980s and then fell to very low levels in the 1990s. More recently small amounts of seismic activity have taken place. Exploration and discovery wells drilling peaked in Canada in the mid-1970s and then dropped to low levels in the early 1990s followed by a slight increase.

Estimated Canadian Arctic Oil and Gas Reserves

The USGS estimates that the Amerasia Basin, which is shared by Canada and the US, holds the second biggest undiscovered oil share in the Arctic, which amounts to ca. 10 billion barrels of oil equivalent (BBOE) and is only topped by Arctic Alaska with approximately three times as much. Counting all the estimated oil reserves together that belong to Canadian provinces or shared provinces with Canada involved, the total oil share is 18.52 BBOE, which is approximately 20.6% of the total undiscovered Arctic oil estimate.

In terms of natural gas, Canadian provinces and provinces shared with the U.S. contain an estimated 124.78 BBOE, which amounts to approximately 7.5% of the total undiscovered gas estimate. The share of undiscovered natural gas liquids is 2.09 BBOE, which corresponds to approx. 4.7% of the total estimate. While the natural gas and natural gas liquids (NGL) estimates are not overwhelming for Canada, the oil estimate – after all one fifth of the total – is large enough to justify at least an exploration interest.

Securing access to these oil resources also explains why Canada has listed securing international recognition of the Canadian continental shelf as one the priorities in its 2010 Arctic Foreign Policy statement.

Canada is conducting scientific studies in order to determine the full extent of the Canadian continental shelf as defined under UNCLOS, which is also important against the background of some of the territorial disputes the country is involved in. According to the Northern Strategy from 2009 and the Foreign Policy Strategy from 2010, Canada is planning to submit its claim to the Convention on the Limits of the Continental Shelf (CLCS) by the end of 2013. In 2004, CAN$ 69 million (approx. € 51 million) have been allocated in the federal budget to carry out the mapping in order to determine the outer limits of Canada’s continental shelf. This amount was further increased by the Canadian Government in 2008 by an additional CAN$ 40 million (ca. € 30 million) for data collection and legal work to enable Canada to present an effective submission to the CLCS.

The 2009 Strategy emphasises that this process “is not adversarial and is not a race. Rather it is a collaborative process based on a shared commitment to international law. Canada is working with Denmark, Russia and the United States to undertake this scientific work” and “[a]ny overlaps with the submissions of neighbouring states will be resolved through peaceful means in accordance with international law”.

Importance of Disputed Areas for Canadian Arctic Oil and Gas Interests

The dispute between Russia, Denmark, and Canada about the Lomonosov and the Mendeleev Ridges, between Canada and the US about the exact boundary in the Beaufort Sea, and between Canada and Denmark about the possession of Hans Island are struggles about land and marine territory and are thus potentially important for Canadian Arctic oil and gas development.

According to the USGS, not many oil and gas resources are expected in the area of the Lomonosov and the Mendeleev Ridges that Russia, Denmark and Canada quarrel about: only 1.11 BBOE of oil are expected in the Lomonosov-Makarov area, 7.16 BBOE of natural gas and just 0.19 BBOE of NGL.The struggle with the US about the exact boundary in the Beaufort Sea is located in an area that is forecasted to be relatively resource-rich, namely the Amerasia Basin. However, the area under dispute is only medium-sized – 6250 nm² – and thus not outstandingly important in terms of Canadian Arctic oil and gas exploitation. Further, there have been indications that the dispute could be settled in the not too distant future in the same fashion as Norway and Russia solved their boundary struggle in the Barents Sea.

Lastly, while Hans Island is located in possibly resource-rich waters in the West Greenland-East Canada area, the dispute between Canada and Denmark is only about the island itself and not about the surrounding waters or the seabed. Thus, this dispute will not be of major relevance to Canada’s oil and gas interests. In conclusion, none of the three disputes is relevant for Canada’s oil and gas development prospects.

This article is part 1 of a background piece about “Canada in the Arctic.” Part 2 can be read here.