Dubai and the Opening Arctic: Russia’s Rosatom and UAE Logistics Company to Cooperate in the Far North

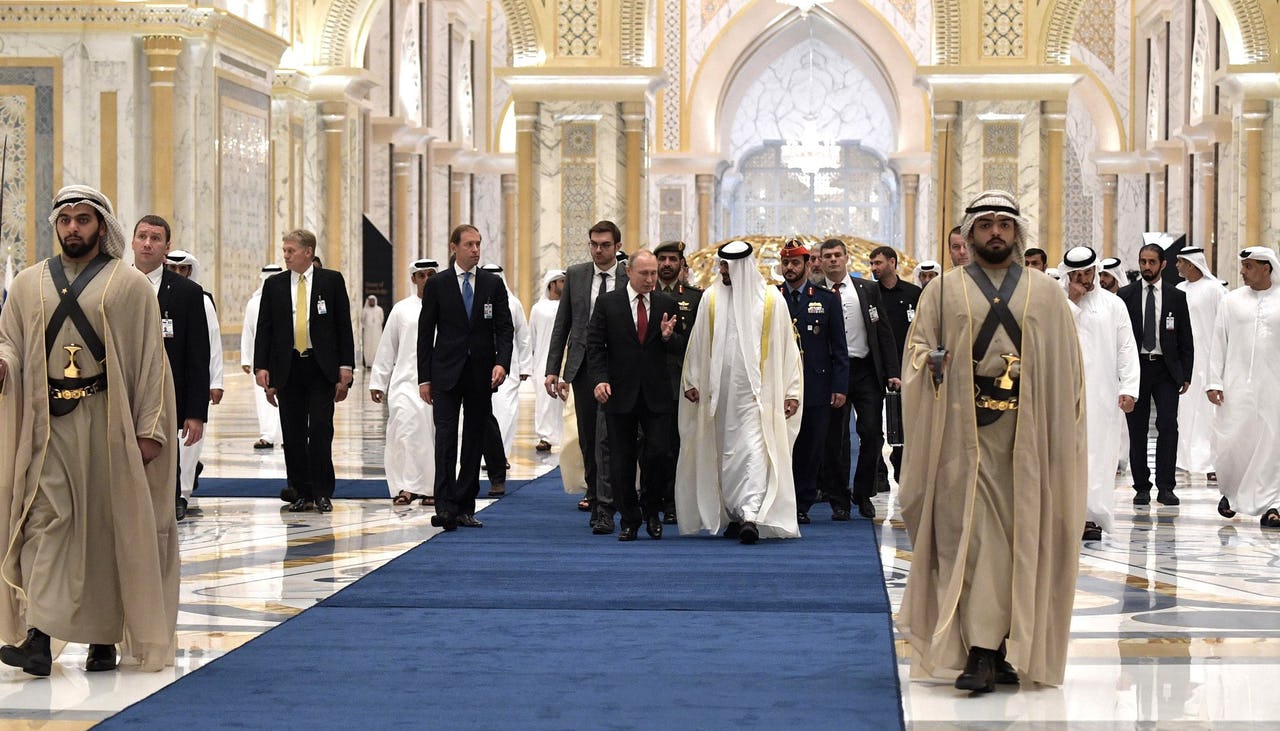

Vladimir Putin paid an official visit to the Emirati capital of Abu Dhabi in 2019 and met with Mohamed bin Zayed in Qasr Al Watan Palace to further discuss the status of the two countries’ relations. Photo: Kremlin.ru

As yet another sign of internationalisation of the Arctic shipping, UAE-based DP World, a global leader in logistics, signed1) an agreement with Russia’s state-owned Rosatom to co-develop and operate cargo services along the Asia-Europe route. Accordingly, Rosatom, which has been federally appointed to manage the Northern Sea Route (NSR), and DP World will co-design a fleet of ice-class container ships that will then be deployed along said route in 2025. What is more, the two corporations will seek to co-develop ports at both ends of the route in Murmansk and Vladivostok, where containers can be transferred from ice-class ships onto ordinary vessels.

Although a deal has been signed, it must be noted that details of it have been in short supply. Still, the significance of the deal cannot be overstated. It illustrates that Arctic shipping in general and shipping along the NSR in particular are now “a new business on a global scale”.2) Commercially, it demonstrates that a growing number of countries and companies share the Russian state’s view on the viability of the route as an alternative to the already established trade routes between Asia and Europe. Politically, it serves as yet another sign of burgeoning relations between the Russian Federation and the United Arab Emirates (UAE). Strategically, finally, it serves as an important reminder that there is a growing need for reconceptualisation of the Arctic governance simply because globalisation of the Arctic could eventually render Arctic eight’s claim to exclusivity counterproductive.

Private actors in UAE foreign policymaking

Highly influenced by the Iraqi invasion of Kuwait and conscious of the UAE’s geography located between two larger and more populous states (Iran and Saudi Arabia), the UAE’s de-facto leader, Mohammad Bin Zayed (MBZ) has been adamant3) about both diversifying the country’s strategic partnerships and expanding its domestic capabilities to reduce its (over)reliance on any one country. The UAE’s recent turn towards a more activist foreign policy, its outreach towards China4) and Russia,5) its strategic use of its financial muscles in investing abroad,6) and its efforts at establishing7) a domestic arms industry must all be seen in this push for increased security via self-reliance and diversification spearheaded by MBZ.

For the UAE, foreign investment and deterritorialisation of its economy is first and foremost a geopolitical endeavour aimed at increasing its national security and its ruling elites’ ability to maintain their hold on power.8) To this end, state-backed companies, or private companies with close ties to the ruling families, are an extension of the country’s foreign and defence ministries whose investments in critical infrastructure and politically significant projects abroad are directed at achieving two broad goals: accrue profit and, more importantly, buy the goodwill and guaranteed cooperation of host governments in both defending the UAE’s territorial integrity and its political system.

This aspect of Emirati foreign policy or strategic decision making is best demonstrated in the case of DP World.9) Established as a result of a merger between Dubai Ports International and Dubai Ports Authority in 2005, DP World is effectively a state-owned enterprise that is managed as a private entity. The company’s CEO and his family have a close relationship with Dubai’s ruling family. Dubai World, the investment arm of the Dubai’s ruling family, owns 80 percent of the company’s shares thereby giving the ruling family ultimate control over the company and its operations. Unsurprisingly, the Emirati government as well as the DP World officials have routinely dismissed the idea of the company working as an extension of the Emirati state by insisting that it is a private company solely motivated by commercial considerations. However, reliable sources have pointed out that DP World’s interests and activities almost always “align with Emirati foreign policy”.10)

What’s in it for the UAE?

As a maritime nation and a global shipping hub, the UAE’s involvement in the Arctic maritime domain is part of its wider strategy of fomenting its position as a key player11) in the Asian cargo and logistic sectors. Considering Asia as its key growth market,12) DP World has a vital interest in the development of the Arctic routes since they considerably shorten the transit time between Asia and Europe. Its foray into the Arctic shipping would enable the UAE to gain a foothold in a fast, and indeed strategically important, emerging maritime zone,13) consolidate its status as a global trading and logistic hub, and strengthen its ties with Russia.

Also at play is the rise of nationalism in the GCC14) as well as the changing trends in the global energy market. Thanks to their similar economic models,15) relations between the Gulf monarchies have been characterised by soft competition over prestige, foreign capital, and technology.

As nationalism gains hold, however, GCC leaders are ever more likely to make their decisions based on what they think is best for their national interests. This type of thinking was on display during the last OPEC+ meeting when the UAE openly opposed Saudi Arabia’s plan for the extension of oil production quotas into next year.16) By enabling Moscow to ramp up both the production and distribution of its Arctic energy, the UAE might be hoping that it could work with Russia in order to influence Saudi’s calculations on the long-term utility of rigid production quotas and/or evert the emergence of a Saudi-Russian partnership that would be blind to UAE’s interests as a major energy producer.

The UAE Pivot in Russia’s Arctic Strategy: moving away from China?

Russia’s cooperation with the UAE has economic benefits, but the foundation of its engagement with the Gulf state is strategic. Working with the UAE not only strengthens Russia’s influence in the Gulf region and global energy markets but also allows Moscow to reduce its dependence on countries like China for the development of its Far North.

Russia relies heavily on Chinese demand to export its Arctic-sourced liquefied natural gas (LNG), but beyond the Yamal Peninsula-based projects, many of the publicised Chinese-backed initiatives have yet to materialise. For example, plans for the development of the Polar Silk Road (China’s extension of the BRI in the Arctic) have stalled as China’s Poly Group has yet to implement its pledged investments in the Arkhangelsk deep-water port and the Belkomur highway that would unite four northern Russian regions.

Moreover, Russian and Chinese interests differ in the Arctic.17) Whereas the region is central to Russia’s economic future, Chinese foreign policy and plans for energy diversification are more concentrated on the Middle East, Central Asia, and Africa. China does not see Russian Arctic-sourced energy as key to their diversification strategy. At the same time, Russia still sees China with some suspicion. In 2020, esteemed Russian Arctic scientist Valery Mitko was arrested for allegedly sharing state secrets regarding Russian submarines with China.18) Moreover, Russia was among the Arctic states initially hesitant to admit China as an observer state to the intergovernmental Arctic Council back when China applied for such status in 2007.19) The Sino-Russian economic partnership, thus, does not preclude mutual suspicions. Seeking to reduce its dependence on China in realising its Arctic ambitions, Russia has turned to countries like Japan20) and India,21) as well as smaller wealthy states like the UAE, to attract investment.

The hard power disparity between Russia and a small state such as the UAE plays a role in Russia’s cooperative strategy in undertaking such a low-risk endeavour with added strategic advantages. Russia’s prominence as a great power that does not seek unilateral hegemony likewise gives Russia an advantage in building strong diplomatic relations with countries in the Global South.22) Russia will be able to deepen its ties with such states, gaining an important foothold in their respective regions, while also bolstering Russia’s role in global energy and transport markets. By welcoming DP World to the Russian Arctic, Moscow may be opening the door to further commercial and strategic collaborations. Russia has previously partnered with the UAE to co-develop fifth-generation fighter aircraft 23) and unmanned aerial vehicles.24) Moreover, Russia has been working to promote a new collective security architecture in the Persian Gulf to resolve regional tensions through multi-format negotiations, but the proposal has seen limited regional support due to concerns over the plan’s feasibility.25)

Lastly, Russia converges with the UAE on prolonging the relevance of oil and its derivatives when the world is increasingly moving towards renewable energy. Both are OPEC+ members and key actors in the 2016 agreement to limit oil production and stabilise prices. Russia and the UAE’s strategic cooperation in the energy sector has resulted in the Abu Dhabi National Oil Company (ADNOC) granting Russia’s Lukoil a 5 percent share in the Ghasha gas concession as well as an ADNOC-Gazprom agreement on upstream, downstream and technology cooperation.26) Therefore, the recent DP World-Rosatom deal may further strengthen Russia’s commercial ties with the UAE and bolster Russia’s position in setting the political agenda regarding energy markets and collective security in the region.

Conclusion: what does it mean for governance in the Arctic

The Arctic’s inadequate transport and communication infrastructure have turned capacity building into a strategic priority for regional states and a useful channel for outside actors to gain and strengthen their presence and influence in the Arctic. A review of the most recent Arctic strategy documents of the Arctic states demonstrates that they all identify a need for technological cooperation and co-investments to build smart and green infrastructure in the region.27) This desire is reciprocated by non-Arctic nations which seem to view capacity building via co-investment as a smart way to both strengthen their foothold in the region and secure their vital commercial interests.

In the case of the UAE, it is not unreasonable to assume that DP World and the UAE government will seek to contribute to both maritime capacity building in the Arctic — with a particular focus on improving and expanding search and rescue facilities — and infrastructure and service development. Doing so will be in line with both the company’s and the UAE government’s patterns of behaviour in other regions where they have used commercial actors and maritime capacity building initiatives to both establish and subsequently justify its presence in locations beyond its immediate neighbourhood. In the Horn of Africa , for example, the UAE government’s use of foreign aid and capacity building have been squarely aimed at furthering the UAE’s strategic depth while DP World has been consistent in its efforts to contribute to infrastructure and communal development initiatives with the sole purpose of polishing its image as a responsible investor.28)

More broadly, DP World’s foray into the Arctic is another sign that as the Arctic becomes globalized, more countries will inevitably seek to establish a commercial presence in it. In other words, as Arctic states begin to invite foreign investment into the region, their very act of facilitating the entry of foreign capital will have ramifications for the regional governance to the point that it might eventually make claims to exclusivity illogical and unattainable. As such, now may be the time for starting discussions on a new and more participatory governance framework for the Arctic and future regulation of foreign investment into the region.

References